Condo Insurance in and around West Lafayette

West Lafayette! Look no further for condo insurance

Insure your condo with State Farm today

Welcome Home, Condo Owners

Looking for a policy that can help insure both your condo unit and the souvenirs, furnishings, sound equipment? State Farm offers impressive coverage options you don't want to miss.

West Lafayette! Look no further for condo insurance

Insure your condo with State Farm today

Condo Unitowners Insurance You Can Count On

When a tornado, fire or a windstorm cause unexpected damage to your condo or someone slips at your residence, having the right coverage is important. That's why State Farm offers such wonderful condo unitowners insurance.

There is no better time than the present to reach out agent Trent Johnson and discover your condo unitowners insurance options. Trent Johnson would love to help you find a policy that fits your needs.

Have More Questions About Condo Unitowners Insurance?

Call Trent at (765) 743-9595 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

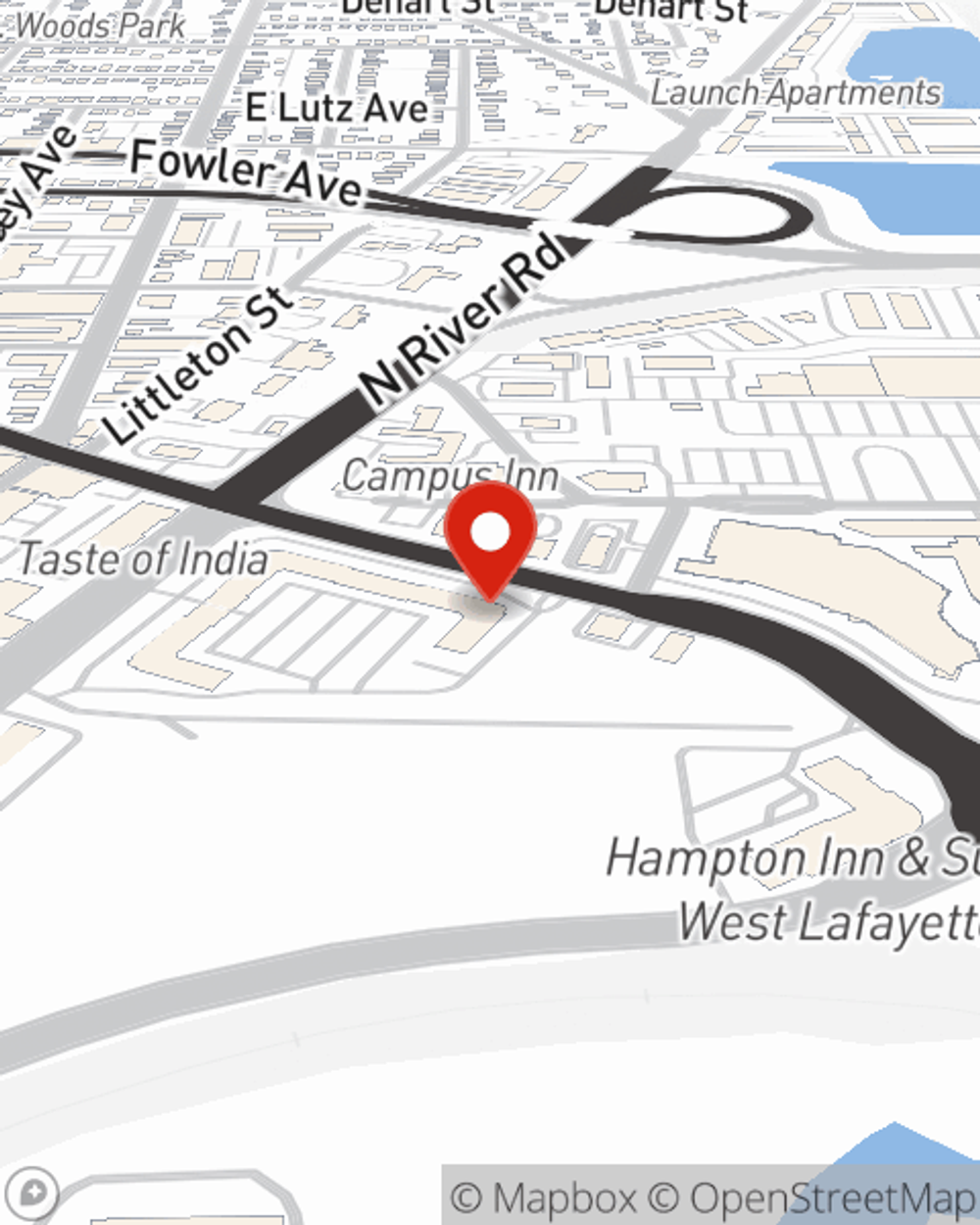

Trent Johnson

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.